What is the minimum salary to pay income tax in Malaysia 2020. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

How Much Does A Small Business Pay In Taxes

Thats a difference of RM1055 in taxes.

. This is based on the number of days spent in Malaysia and should not be confused with. How much salary need to pay income tax in malaysia Full salary after tax calculation for Malaysia based on RM1000000 annual salary and the 2022 income tax rates in Malaysia. If you need to check total tax payable for assessment year 2022 just enter your 2021 yearly income into the Bonus field.

Calculation of yearly income tax for assessment year 2022. Any individual earning more than. Malaysia has a progressive tax system with rates ranging from 0 percent to 28 percent.

An individual who earns an annual employment income of RM25501 after deducting EPF contributions or. You must pay income tax on all types of income. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022.

Many Malaysians may find the tax filing process a littlewell taxing but were here to help. Calculate your monthly take home pay in 2022 thats your 2022 monthly salary after tax with the Monthly Malaysia Salary Calculator. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

Malaysias personal income tax follows a progressive tax system. Personal income tax rates. How much is taxable income in Malaysia for Year Assessment 2021.

The system has a wide range of marginal tax brackets. What is Malaysias personal income tax rate. Malaysia Monthly Salary After Tax Calculator 2022.

This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for 2021. How much tax will be deducted from my salary in Malaysia. 13 rows An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in or derived from Malaysia.

Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. Here is a definitive guide to help you both learn and file your personal income tax and corporate income tax. How much tax will be deducted from my salary in Malaysia.

Alternatively you can select one of the example salary after tax examples listed below these cover generic salary packages based on annual income in Malaysia. Our calculation assumes your salary is the same for 2020 and 2021. PCB is still deducted as per normal from hisher monthly salary.

Heres our complete guide to filing your income taxes in Malaysia 2022 for the. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out. Income Tax Malaysia 2019 and 2020.

RM9000 for individuals.

How To Calculate Income Tax In Excel

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Income Tax Formula Excel University

Finland Taxing Wages 2021 Oecd Ilibrary

Income Tax Formula Excel University

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

How To Calculate Foreigner S Income Tax In China China Admissions

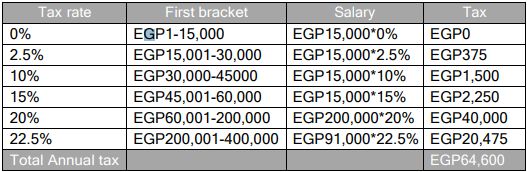

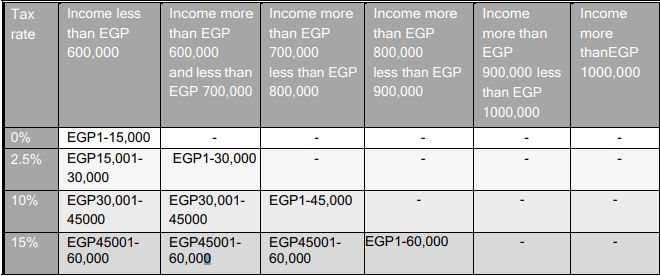

Latest Amendments In Income Tax Law In Egypt Law No 26 2020 Income Tax Egypt

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

What Is The Income Tax Slab In Singapore Quora

Cukai Pendapatan How To File Income Tax In Malaysia

China Annual One Off Bonus What Is The Income Tax Policy Change

How To Calculate Income Tax In Excel

Latest Amendments In Income Tax Law In Egypt Law No 26 2020 Income Tax Egypt

States Continue To Take Steps Toward Income Tax Elimination

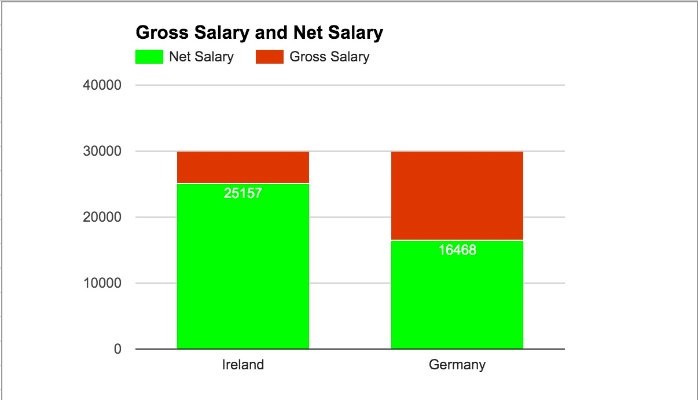

Income Tax Germany Versus Ireland

Individual Income Tax In Malaysia For Expatriates